| Shares: 204M issued, 225M fully diluted at 23 Sep 2021 | |

| Date / Location of update |

Comments |

| 24th January 2022 Weekly (Stock price: A$0.36) |

Technology Metals Australia (TMT.AX) announced the expansion of an existing Memorandum of Understanding (MOU) with Japanese company LE System (LES). The expanded MOU provides the framework for TMT and LES to jointly undertake a Feasibility Study into the development of vanadium electrolyte — for use in Vanadium Redox Flow Batteries — production capacity in Australia, utilising vanadium from TMT’s Murchison Technology Metals Project (MTMP) and LES’s proprietary vanadium electrolyte technology. LES will provide technical support and collaboration under a technology licencing agreement. TMT’s goal is to build Australia’s first fully integrated mine-to-battery vanadium electrolyte plant.

This has the potential to add substantial value for TMT shareholders, with “potential” being the operative word at the moment. |

| 20th December 2021 Weekly (Stock price: A$0.31) |

Technology Metals Australia (TMT.AX) decided a few months ago to combine the Gabanintha Vanadium Project (GVP) and the Yarrabubba Iron-Vanadium Project to form the Murchison Technology Metals Project (MTMP). This resulted in a change of plan. Instead of completing an FS for Yarrabubba in December-2021 as originally scheduled, the company began working towards an Integration Study.

According to a press release last Tuesday: “Work is progressing on an “Integration Study” designed to optimise the integration of Yarrabubba ore into the expanded MTMP. Benefitting from the very high quality GVP DFS, the “Integration Study” is expected to be completed in mid 2022 and will deliver optimised production, operating costs, capital costs and financial model to enable the timely progression of project financing. The MTMP Global Measured and Indicated MRE is expected to support a project life in excess of 25 years.” That is, we should get very important news from TMT in mid-2022. |

| 15th November 2021 Weekly (Stock price: A$0.37) |

Technology Metals Australia (TMT.AX) reported a substantial increase in the estimated vanadium (V2O5) resource at its Murchison Technology Metals Project (MTMP) in Western Australia. Of particular significance, the MTMP’s M&I resource has increased by 27% to 50.2Mt at 0.9% V2O5. This is part of a total mineral resource that is now estimated to be 146.2Mt at 0.8% V2O5.

This is positive news. |

| 1st November 2021 Weekly (Stock price: A$0.38) |

Technology Metals Australia (TMT.AX) issued its quarterly activities report for the quarter ending 30th September 2021. The company is developing the Gabanintha Vanadium and Yarrabubba Iron-Vanadium projects in Western Australia.

The most significant change during the latest quarter was the company’s decision to combine Gabanintha and Yarrabubba to form the Murchison Technology Metals Project (MTMP). This has delayed the FS for Yarrabubba to beyond its previously scheduled December-2021 completion date, but we view the change as positive because it should result in superior economics. TMT had A$3.7M of cash at 30th September, but due to a subsequent A$20M equity financing the company should be fully funded for the next 12 months. |

| 27th September 2021 Weekly (Stock price: A$0.41) |

Technology Metals Australia (TMT.AX) has raised A$20M by issuing new shares at A$0.375 per share. Although the new shares were issued at a discount to the market price, for two reasons the announcement of the financing caused the market price to rise. The first reason is that Resource Capital Fund (RCF) will be purchasing the majority of the new shares, giving the fund management company an 18% stake in TMT. The second reason is that the $20M will be used to accelerate the development of the Gabanintha Vanadium Project (GVP) and the Yarrabubba Iron-Vanadium Project as a single, integrated project that should have superior economics to those estimated in the GVP’s 2019 FS.

The plan, now, is to revise the GVP FS to incorporate the processing of ore from Yarrabubba with the goal of making a Final Investment Decision (FID) during the second half of 2022. In addition to revising the GVP FS, getting to the FID will require more pilot testing. This news is positive. It confirms that TMT is a good way to have long-term exposure to vanadium. |

| 20th September 2021 Weekly (Stock price: A$0.45) |

Technology Metals Australia (TMT.AX) is developing the Gabanintha Vanadium Project and the Yarrabubba Iron-Ore Project in Western Australia. Our main interest in TMT stems from its vanadium (V2O5) exposure, but the company’s immediate focus is the iron-ore project (which, by the way, has significant vanadium and titanium by-products).

Last Thursday TMT reported the following exceptional intercepts from infill and extensional drilling at Yarrabubba: – 24m @ 50.2% Fe, 1.13% V2O5 and 12.8% TiO2 from 176m – 26.5m @ 46.6% Fe, 1.06% V2O5 and 12.1% TiO2 from 21.5m – 67m @ 36.6% Fe, 0.81% V2O5 and 9.4% TiO2 from 69m The drilling results should lead to increased estimates of mineral resources and reserves. |

| 2nd August 2021 Weekly (Stock price: A$0.35) |

Technology Metals Australia (TMT.AX) issued its quarterly activities report for the quarter ending 30th June 2021. The company is developing the Gabanintha Vanadium and Yarrabubba Iron-Ore projects in Western Australia. Our interest in TMT is mainly due to the vanadium project, but most of the company’s work at the moment is directed towards completion of the FS for the iron-ore project. The FS is scheduled to be completed during the December-2021 quarter.

TMT had A$5.6M of cash at 30th June. This would be enough to fund the business for about three more quarters at the current rate of spending, but we expect that the company will top up its treasury before year-end. |

| 28th April 2021 Interim (Stock price: A$0.35) |

Vanadium is an interesting commodity at this time, because:

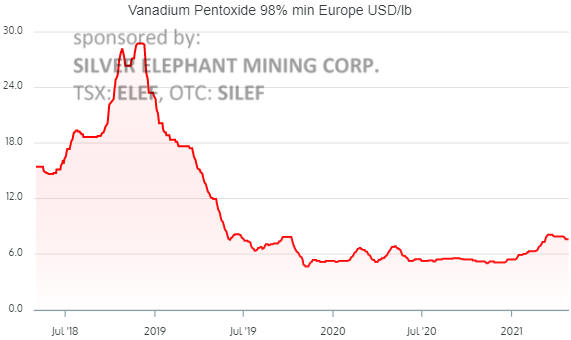

1) Due to its use as a steel additive (the addition of a small amount of vanadium can increase the hardness of steel by 100%), its demand could be given a hefty boost over the next 12 months by an extension of the post-pandemic global economic rebound and the US government’s infrastructure spending program. 2) It could play an important role in the clean energy revolution due to its use in grid-level redox flow batteries. 3) Its price remains low relative to the past five years. Here is a chart showing the Vanadium Pentoxide (V2O5) price over the past three years:

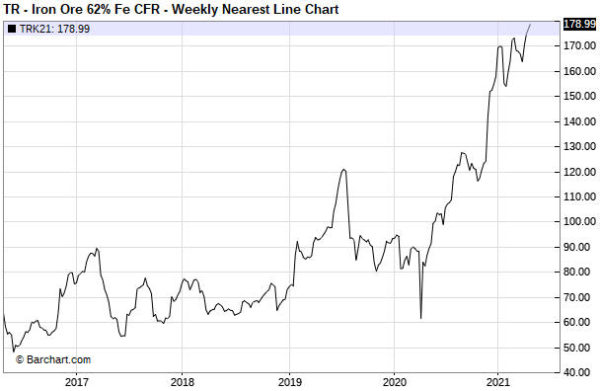

The best way for most investors to have exposure to vanadium is to own the shares of Largo Resources (LGO in both Canada and the US). LGO has current profitable production of about 20M pounds/year of V2O5, a strong balance sheet and a nascent Vanadium Redox Flow Battery (VRFB) business. LGO would be a reasonable candidate for new buying if it were to pull back to near the bottom of its 3-month range (that is, C$17-$18). Another way to have exposure to vanadium is via the shares of Technology Metals Australia (TMT.AX). TMT has been in our Small Stocks Watch List (SSWL) for the past 2.5 years, but we have decided to move it into the TSI Stocks List as a long-term position. The company has 150M shares outstanding, about A$7M of cash and a market cap of A$53M at its current share price (A$0.35). TMT originally was put into the SSWL (rather than the TSI Stocks List) due to its lack of liquidity and the speculative nature of its mineral assets. The stock remains illiquid, so it should be traded in small tranches using limit orders only. However, over the past two years the company has made considerable progress at its flagship Gabanintha Vanadium Project (GVP) and also has progressed the Yarrabubba Iron-Vanadium Project (YIVP) to the Feasibility stage (both projects are located near Meekathara, Western Australia). As a result, it now has a far more substantial asset base. Based on the FS completed in August-2019, for US$318M the GVP could be developed into a mine that produces 28M pounds/year of V2O5 at a relatively low cash cost of US$4.04/pound. At a V2O5 price of US$8.78/pound (about 15% above the current price), the estimated post-tax NPV(8%) and IRR are A$409M and 17%, respectively. At a V2O5 price of US$10.88/pound, the estimated post-tax NPV(8%) and IRR are A$870M and 27%, respectively. In other words, a 24% increase in the V2O5 price increases the project’s NPV by more than 100%. This is called leverage to the commodity price, which is a good thing to have in a commodity bull market. TMT has signed off-take agreements covering more than 50% of GVP’s planned production. This indicates that the GVP’s output will be acceptable to vanadium consumers and that the consumers are prepared to work with TMT. The YIVP, TMT’s other mineral asset, is an iron-ore deposit with a vanadium by-product. The iron-ore price has more than doubled over the past 12 months and is now at an all-time high (see chart below), so this is a good time to have iron-ore exposure. We doubt that the current high iron-ore price will prove to be sustainable beyond the next few months, but we don’t mind getting exposure to iron-ore for free. Given that the GPV’s NPV is about eight times the company’s current market cap, buyers of TMT shares near the current price effectively get iron-ore exposure for free. The YIVP’s economics are in the process of being determined via a Feasibility Study scheduled for completion in September of this year.

It is easy for us to come up with a valuation of A$1-$2/share for TMT, or several times the current share price. However, we expect that the speculative demand for TMT and similar stocks will be low until the V2O5 price makes a solid and sustained break above US$8.00/pound. There’s no way of knowing when that will be, so it’s possible that the stock will continue to trade at a large discount to its potential value for a long time. Bear this in mind. Lastly, TMT’s price chart looks constructive and played a part in our decision to feature the stock in today’s report. As mentioned above, TMT has been added to the TSI List at A$0.35. |

Copyright © speculative-investor.com